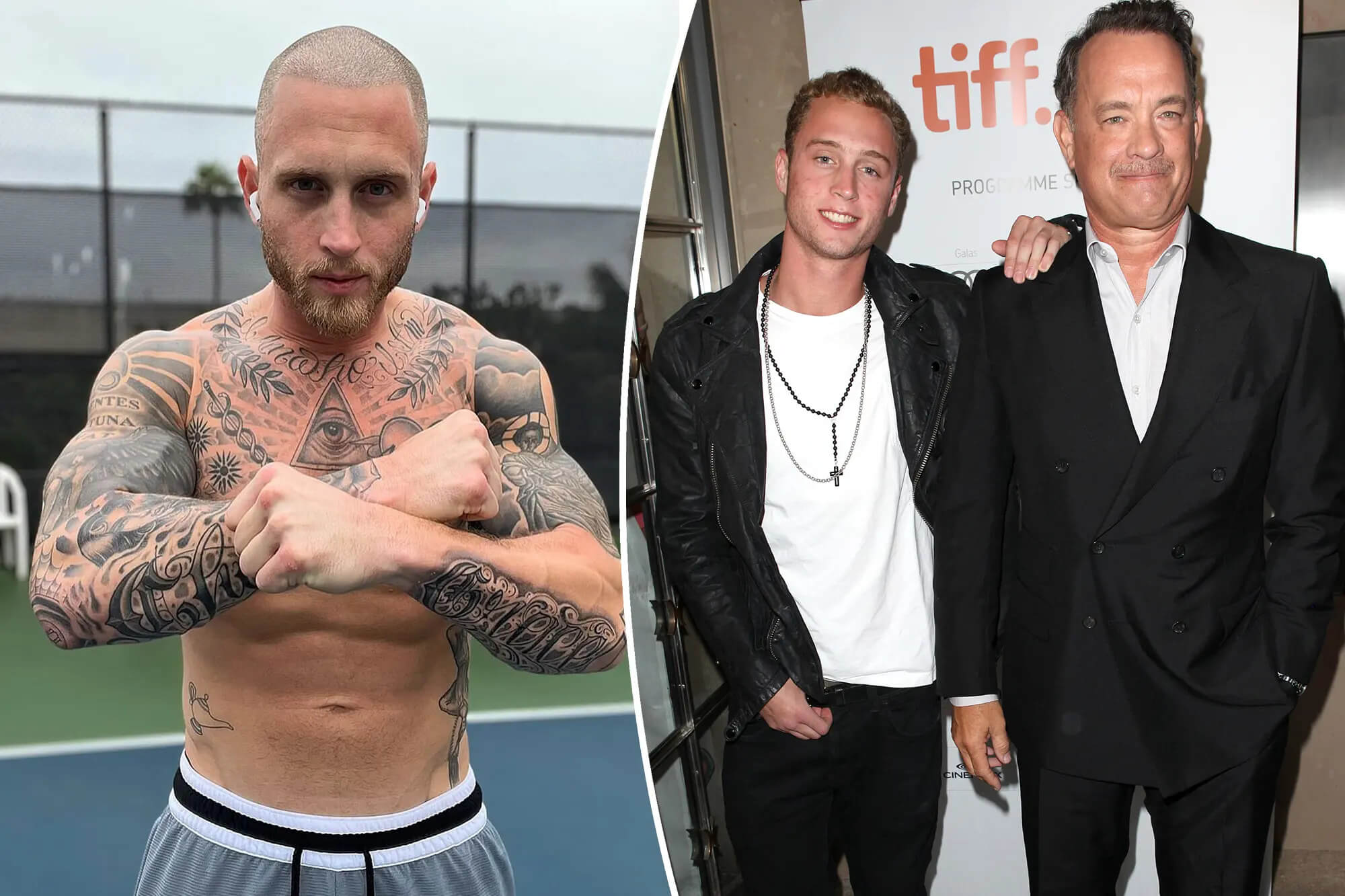

Many people are, quite naturally, curious about the financial standing of public figures, and searching for "Chet Hanks net worth 2024" is a common query that pops up on the internet. It's really understandable to want to know more about the wealth and financial journey of individuals who are often in the public eye, like actors or musicians. This kind of information, you know, can offer a glimpse into their careers and how things are going for them, especially as we move through the year.

However, when we look into the specifics of "Chet," it’s interesting to find that the name itself holds a few different meanings and associations. While many might immediately think of a particular celebrity, the term "Chet" also refers to something entirely different, something perhaps a bit more grounded in everyday financial planning for many families. So, it's almost like there are two distinct paths when you hear that name, each with its own set of details and implications for people.

This article will, in a way, explore what we can share about "Chet" based on the information we have at hand. Our focus will be on the details provided to us, which actually shed light on the origins of the name "Chet" and, quite importantly, a specific financial program known as the CHET 529 College Savings Program. We won't be able to talk about the personal wealth of any individual named Chet Hanks, as that information isn't part of our current data. Instead, we'll look at what "Chet" means in a broader sense, especially concerning a valuable savings opportunity for education.

Table of Contents

- Understanding the Name 'Chet'

- The CHET 529 College Savings Program: A Closer Look

- The CHET Advance Scholarship Program

- Frequently Asked Questions About Chet Hanks Net Worth 2024

Understanding the Name 'Chet'

So, let's talk a little bit about the name "Chet" itself. It's actually a masculine given name, and you know, it's quite often used as a kind of shortened version, a nickname really, for the name Chester. The meaning behind Chester is rather interesting, as it typically refers to a "fortress" or a "camp." This gives the name a sort of strong, grounded feel, which is pretty neat when you think about it.

It's also worth noting that "Chet" isn't what you'd call a very common name, at least not anymore. It has origins in English, apparently, and it first came about as a surname. This means, in a way, that it was used to help identify people who came from a particular place or had some kind of specific background. So, you can see how names evolve over time, which is actually quite fascinating, isn't it? It just goes to show how words and names have their own long stories.

The name's journey from a surname to a given name, and then often a nickname, is a pretty good example of how language shifts. You know, it's not something you hear every day, which perhaps gives it a certain unique quality. So, while some people might be looking for information on a specific person, the name "Chet" itself has a rich, albeit somewhat uncommon, history that is tied to old English roots and the concept of a fortified dwelling or settlement. It's a name that carries a sense of stability and protection, which is a rather nice thought.

The CHET 529 College Savings Program: A Closer Look

Now, shifting gears a bit, let's talk about the "CHET" that's quite different from a person's name, but still very important. We're referring to the CHET 529 College Savings Program. This program, which is sponsored by the Connecticut Office of the Treasurer, is a really helpful initiative. It's managed by Fidelity, a well-known financial company, which adds a layer of trust and experience to the whole setup. This program is, in some respects, designed to help families save for future educational costs, and it comes with some pretty good perks, too.

One of the main draws of the CHET 529 College Savings Program is that it offers a number of financial advantages. These include, for instance, certain tax benefits that can make saving for college a bit easier on your wallet. It also provides a lot of flexibility in how you can use the funds once they've been saved. Plus, there are various investment choices available, allowing people to pick options that best fit their financial comfort levels and goals. So, it's not just a savings account; it's a tool with several features to support educational funding.

The funds accumulated within this program are quite versatile, too. They can be used at a wide range of educational institutions, which is a big plus. We're talking about accredited colleges and universities across the nation, so basically, wherever a student might choose to pursue higher education, these savings can likely go with them. This broad applicability means that families have a lot of freedom in selecting the right academic path without being limited by where their savings can be spent, which is a very practical benefit for planning ahead.

Tax Advantages for Connecticut Residents

For those living in Connecticut, the CHET Advisor 529 Plan offers some rather appealing tax benefits, which is pretty significant. Connecticut residents may, for instance, deduct a certain amount of their contributions from their taxable income each year. This is a direct benefit that can help reduce what you owe in state income taxes, which is always a welcome relief for families trying to manage their finances.

Specifically, individuals filing taxes in Connecticut can deduct up to $5,000 of their taxable income annually when they contribute to the CHET 529 plan. For couples who are filing jointly, that deduction doubles, allowing them to deduct up to $10,000. This kind of tax incentive is, you know, a clear way the state encourages saving for education, making it a bit more financially attractive for its residents to plan for their children's or their own future schooling costs. It really makes a difference for many households looking to save smart.

So, the ability to reduce your taxable income just by saving for college is a powerful incentive. It means that while you're putting money aside for a very important future expense, you're also potentially saving money on your current year's state taxes. This dual benefit is, in some respects, what makes the CHET 529 plan a particularly smart choice for those living in Connecticut who are thinking about higher education expenses. It's a way to get a little help from the state while you help yourself, which is a pretty good deal, really.

Flexible Use of Funds

One of the truly great things about the CHET 529 College Savings Program is how flexible it is when it comes to using the money. The funds, you see, are not tied down to just one type of school or a specific location. They can be put towards expenses at a wide variety of educational institutions, which is a big plus for families who want options for their students.

We're talking about accredited colleges and universities, which means institutions that meet certain quality standards, and these are located all across the nation. So, whether a student dreams of attending a large state university, a small private college, or even a technical school, the funds saved in a CHET 529 plan can generally be used there. This kind of broad acceptance really provides peace of mind, knowing that your savings will be useful no matter where your educational journey takes you, which is very reassuring for future planning.

This flexibility also extends to the types of qualified educational expenses that the funds can cover. While the provided text focuses on colleges and universities, typically 529 plans can help with tuition, fees, books, supplies, and even room and board for students enrolled at least half-time. This means that families aren't just saving for tuition; they're saving for a more complete picture of what college life actually costs, which is a pretty comprehensive approach to educational funding. It just makes the whole process a lot more manageable, really.

Investment Choices

When you put money into the CHET 529 College Savings Program, you're not just stashing it away in a regular savings account; you actually have a say in how that money is invested. The program offers various investment choices, which is a pretty important feature for people who want their savings to grow over time. This means you can pick options that align with your comfort level regarding risk and your financial goals, which is quite empowering for savers.

Having different investment choices means that you can tailor your strategy, in a way, to fit your timeline and your personal preferences. Some people might prefer options that are more conservative, especially if the student is closer to needing the funds, while others might choose more growth-oriented investments if they have a longer time horizon. This ability to select from various investment approaches, you know, allows for a more personalized savings plan, which is really beneficial for maximizing potential returns while managing risk.

The fact that Fidelity manages the program also means that these investment choices are typically backed by professional expertise and a range of well-established funds. This can give savers a bit more confidence in their decisions, knowing that their money is being handled by experienced financial managers. So, it's not just about putting money in; it's about strategically growing that money through thoughtful investment, which is a key part of long-term financial planning for education, as a matter of fact.

The CHET Advance Scholarship Program

Beyond the college savings plan, there's another very helpful initiative connected to "CHET" that's worth knowing about: the CHET Advance Scholarship. This program, which used to be known as the CHET Advance Scholarship for High School Seniors, is an annual opportunity designed to give students a boost. It's offered by the Connecticut State Treasurer’s Office, which shows a real commitment to supporting educational aspirations within the state.

This scholarship program is set up to help students, particularly those who are nearing the end of their high school years, get some financial assistance for their future studies. It's an annual offering, so it's something that families and students can look forward to and plan for each year. The goal, apparently, is to lighten the financial load of pursuing higher education, making it a bit more accessible for deserving students, which is a pretty noble aim.

The existence of the CHET Advance Scholarship really complements the 529 savings program. While the 529 plan encourages families to save proactively, the scholarship provides direct financial aid, which can be a huge help for many. It's another way the state, through the Treasurer's Office, is working to support its residents in achieving their educational dreams. So, whether through saving or through direct aid, the "CHET" initiatives are clearly focused on making college a more attainable goal for many, which is a very positive thing, really.

To learn more about college savings and financial planning, you might find some useful information on general financial literacy sites like Investor.gov, which can offer broad guidance on educational funding.

Frequently Asked Questions About Chet Hanks Net Worth 2024

Many people are curious about the financial standing of public figures, and searches related to "Chet Hanks net worth 2024" are quite common. While we understand this interest, the information provided to us for this article focuses specifically on the CHET 529 College Savings Program and the general meaning of the name "Chet." As such, we cannot provide details on the personal net worth of any individual named Chet Hanks.

Here are some questions people often ask, along with what we can say based on our available information:

How much is Chet Hanks estimated to be worth in 2024?

Based on the text provided for this article, there is no information available regarding the estimated net worth of Chet Hanks for 2024 or any other year. Our given information pertains to the CHET 529 College Savings Program and the origins of the name "Chet." So, we can't really speak to that specific financial query about an individual, unfortunately.

What are Chet Hanks' main sources of income?

Our provided text does not contain any details about the main sources of income for Chet Hanks. The information we have is about the CHET 529 college savings program, which offers tax advantages and flexible use of funds for educational purposes, and the etymology of the name "Chet." Therefore, we cannot answer questions about an individual's income streams from this source, which is, you know, a bit of a limitation for this particular question.

Has Chet Hanks' net worth changed significantly in recent years?

We do not have any data within our provided text that would allow us to comment on whether Chet Hanks' net worth has changed significantly in recent years. The available information is entirely focused on the CHET 529 College Savings Program, its benefits for Connecticut residents, and the historical background of the name "Chet." So, any discussion of personal financial changes for an individual is outside the scope of what we can provide here, which is just the way it is with the information we have, you know.

Learn more about educational savings programs on our site, and link to this page .

Detail Author:

- Name : Ms. Ollie Hudson

- Username : mdavis

- Email : stefan97@hotmail.com

- Birthdate : 2004-04-15

- Address : 14536 Moore Crescent Apt. 767 Lake Hillaryfurt, MA 47459

- Phone : 1-508-410-8846

- Company : Auer, Kuphal and White

- Job : Teacher Assistant

- Bio : Perferendis non odit occaecati expedita sunt id ratione. Quas distinctio voluptatem molestias illum voluptatum saepe culpa. Ex dolorem est id eos voluptate molestiae impedit.

Socials

linkedin:

- url : https://linkedin.com/in/toy_dev

- username : toy_dev

- bio : Provident occaecati voluptatem in id sed sed.

- followers : 3503

- following : 1564

facebook:

- url : https://facebook.com/toy_official

- username : toy_official

- bio : Consequatur sunt ipsum quos at sed.

- followers : 4406

- following : 928