Have you ever found yourself wondering about the financial standing of someone whose name pops up frequently, like a "Michael Robinson," and what exactly contributes to their wealth? It's a rather common curiosity, you know, especially when names resonate with so many different facets of life and industry. We often hear about prominent figures, or even just successful individuals, and a natural question that comes to mind is that of their net worth, which is, in a way, a snapshot of their financial health at a given moment.

Figuring out someone's net worth, however, is a bit more involved than just looking up a single number. It’s a pretty complex calculation, actually, taking into account all the things a person owns versus all the things they owe. This kind of financial picture can tell us quite a lot about their economic journey and the paths they've taken to accumulate assets, whether those are from thriving businesses, smart investments, or even from significant roles in various fields.

This article will explore the general concept of net worth, what it truly means, and the various elements that shape it. While our provided text touches on "Michael" in many interesting ways—from the archangel to a major retail chain and even a film—it doesn't actually provide specific financial details for an individual named "Michael Robinson." So, we'll think about how different types of "Michaels" might build wealth, using the rich tapestry of the name from our source to illustrate the many ways financial success can unfold, you know, in a broad sense.

Table of Contents

- Understanding Net Worth: What It Really Means

- Exploring the Identity Behind "Michael Robinson"

- The Components of Financial Standing

- How Different Types of "Michael" Might Build Wealth

- Analyzing Potential Income Streams

- Factors Influencing Financial Growth

- The Importance of Financial Planning

- Frequently Asked Questions About Net Worth

- Final Thoughts on Financial Journeys

Understanding Net Worth: What It Really Means

When people talk about net worth, they are really referring to the total value of all a person's assets minus all their liabilities. It's a pretty straightforward calculation in theory, but it gets a little more involved when you consider all the different things that count as assets and liabilities. Assets are things you own that have value, like your home, cars, investments, savings accounts, and even valuable collections. Liabilities, on the other hand, are the things you owe, such as mortgages, car loans, credit card debt, and student loans.

A positive net worth means your assets are worth more than your debts, which is, you know, generally a good sign of financial health. A negative net worth means you owe more than you own, which can indicate a need for some financial adjustments. So, in some respects, net worth isn't just a number; it's a way of looking at your entire financial picture, giving you a clear idea of where you stand economically at any given moment. It typically fluctuates, too, as asset values change and debts are paid down or accumulated.

This concept is truly central to understanding anyone's financial journey, whether they are a prominent figure or someone just starting out. It's a snapshot, really, that can inform future financial decisions and strategies. For someone like a "Michael Robinson," whose name might bring to mind various contexts, understanding their net worth would mean looking at all these pieces of their financial puzzle.

Exploring the Identity Behind "Michael Robinson"

It's quite interesting, isn't it, how a name like "Michael Robinson" can spark curiosity about financial standing? However, it's important to clarify that our source material, while rich with mentions of "Michael," does not provide specific biographical or financial details for an individual named "Michael Robinson." The text mentions "Michael" in several distinct contexts, giving us a broader perspective on the significance and varied associations of the name itself.

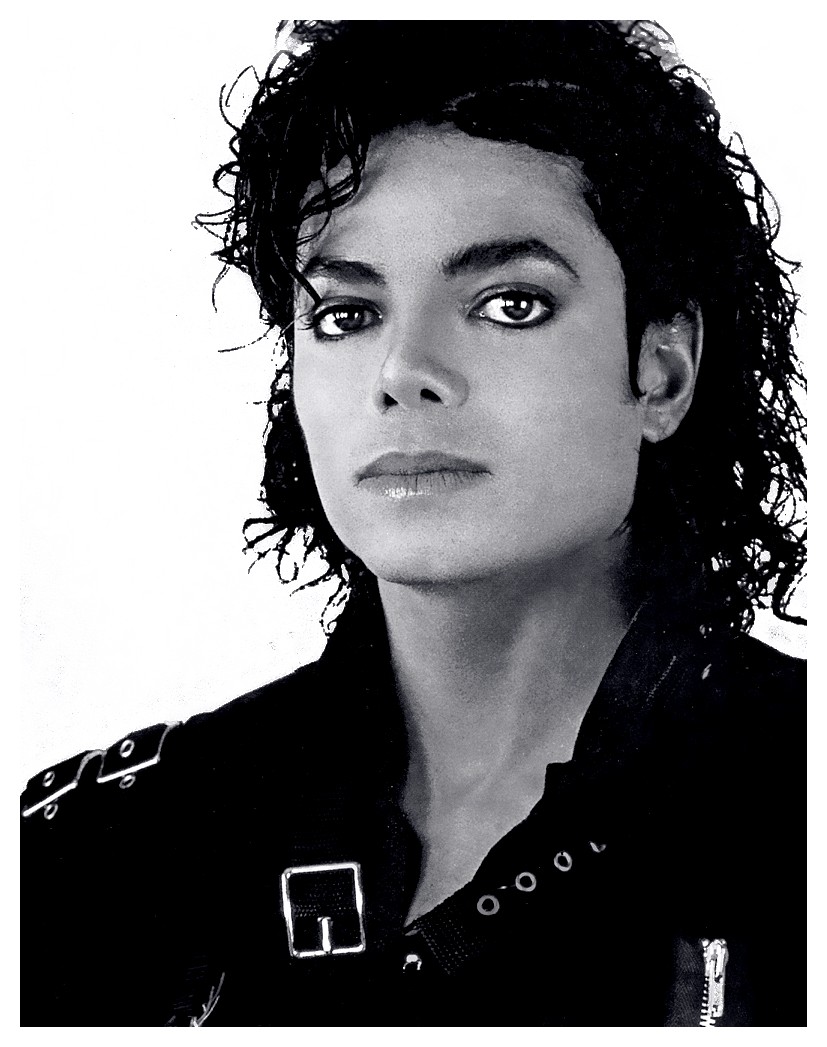

For instance, the text talks about "Michael the Archangel," a figure of immense spiritual importance, depicted as a warrior and protector, leading heavenly hosts. This "Michael" is revered across different faiths, representing power, leadership, and divine influence. Then, there's the reference to "Michaels stores," which is described as North America's largest retailer of arts and crafts materials, a massive business with over 1250 stores. This suggests a "Michael" associated with significant commercial enterprise and widespread retail presence.

The text also brings up "Michael" in the context of a film about Jackson's legacy, featuring Hollywood veterans. This points to a "Michael" connected to the entertainment world, a place where considerable financial success and public visibility are often found. So, while we don't have a specific "Michael Robinson" from our source, these varied mentions of "Michael" do give us a fascinating backdrop against which to discuss how different kinds of endeavors can lead to financial accumulation.

The Components of Financial Standing

When we talk about financial standing, it’s about more than just how much money someone has in their bank account. It's a pretty comprehensive picture, actually, built from various components that contribute to a person's overall net worth. Assets, for example, can be quite diverse. They include liquid assets like cash and savings, but also investments such as stocks, bonds, mutual funds, and retirement accounts. Real estate, whether it's a primary residence, vacation homes, or commercial properties, also forms a very significant part of many people's assets.

Beyond these common categories, assets can also extend to valuable personal property, you know, like art collections, jewelry, vehicles, or even intellectual property if someone is a creator or inventor. On the other side of the ledger are liabilities, which are basically all the financial obligations a person has. This means mortgages, car loans, student loans, and credit card balances. Sometimes, there are also personal loans or other forms of debt that need to be accounted for.

Understanding these different components is crucial because they all play a part in calculating that final net worth figure. It’s not just about what you earn, but what you own and what you owe. A high income doesn't always mean a high net worth if liabilities are equally substantial, or if assets aren't being built effectively. So, in some respects, it's a balance.

How Different Types of "Michael" Might Build Wealth

Considering the various ways the name "Michael" appears in our text, we can, in a way, think about how different kinds of prominent figures might accumulate financial standing. It's really interesting to explore these hypothetical scenarios, even without specific details for a "Michael Robinson." Each context offers a distinct path to wealth or influence that, you know, often translates into significant financial standing.

Business Acumen and Retail Success

The mention of "Michaels stores" as North America’s largest retailer of crafts, craft supplies, and art supplies gives us a pretty clear picture of how a "Michael" could build considerable wealth through business. Someone at the helm of such an enterprise, or even a key founder, would likely have a very substantial net worth. This would come from the value of the company itself, their equity in it, and any dividends or salaries earned over years of operation.

Running a business with over 1250 stores across the USA and Canada, as Michaels does, involves massive revenue generation and significant asset accumulation for the company, which then reflects on its owners or top executives. The focus on "empowering makers to unleash their creativity" also speaks to a successful business model that resonates with a broad customer base, leading to sustained growth and, you know, financial prosperity. This kind of entrepreneurial spirit is a common path to wealth.

Influence and Impact Beyond the Material

Then there's "Michael the Archangel," a figure described with immense significance, a warrior of God, a protector, and a leader of heavenly hosts. While this "Michael" doesn't accumulate earthly wealth in the traditional sense, his influence is, you know, immeasurable. In a metaphorical way, one could argue that influence, authority, and the ability to inspire or protect are forms of "worth" that, for human figures, often translate into significant societal standing, which can then open doors to financial opportunities.

For a person named Michael who holds a position of great influence or moral authority, their "net worth" might include not just financial assets but also their social capital, their reputation, and their ability to effect change. These intangible assets, you know, often play a very crucial role in building a comprehensive picture of a person's standing, even if they don't show up on a balance sheet.

The World of Entertainment and High-Profile Careers

The reference to "Michael" featuring "a number of Hollywood veterans helping to bring Jackson's legacy... to life on screen" points to the entertainment industry. This is a sector where individuals, particularly those involved in high-profile productions as actors, directors, or producers, can command very substantial incomes. Their net worth would typically include earnings from film roles, endorsements, production deals, and, you know, possibly even residuals from past projects.

Hollywood veterans, as mentioned, are often at the peak of their careers, having built up years of experience and a strong reputation, which allows them to negotiate very lucrative contracts. The financial success in this field is often tied to public visibility and the ability to draw large audiences, which can lead to, you know, truly significant financial accumulation over time. So, a "Michael" in this sphere would likely have a net worth reflective of a highly successful career in entertainment.

Analyzing Potential Income Streams

When we think about how someone builds their net worth, looking at their income streams is pretty important, actually. For a hypothetical "Michael Robinson," depending on their professional path, these streams could be incredibly varied. If they are involved in a large retail operation, like the "Michaels stores" mentioned in our text, a significant portion of their income might come from executive salaries, bonuses, and equity in the company. This could also include dividends if they hold shares.

For someone in the entertainment industry, perhaps like the "Hollywood veterans" associated with the "Michael" film, income streams would typically include upfront fees for roles, profit participation, endorsement deals, and perhaps even their own production company earnings. These can be very substantial, you know, especially for well-established figures. Beyond these, there are always investment returns from stocks, bonds, or real estate, which can be a pretty passive yet powerful way to grow wealth over time.

Additionally, some individuals generate income from intellectual property, such as royalties from books, music, or patents. Consulting fees, speaking engagements, or even revenue from online content creation are also becoming, you know, increasingly common income sources. The more diverse and robust these income streams are, the more potential there is for a person's net worth to grow and become more resilient to economic shifts.

Factors Influencing Financial Growth

A person's financial growth and, you know, their eventual net worth are shaped by a pretty wide array of factors. It's not just about how much money they make, but also how they manage it. Personal spending habits, for instance, play a very crucial role. Someone with a high income but equally high expenses might struggle to build significant wealth, while someone with a moderate income but disciplined spending habits could, in some respects, accumulate more.

Investment strategies are also incredibly important. Whether someone opts for conservative investments like bonds or more aggressive options like growth stocks, their choices directly impact how quickly their assets appreciate. The economic climate, too, has a pretty big influence; periods of economic growth and strong markets can boost asset values, while downturns can, you know, reduce them. Inflation and interest rates also play a part, affecting the purchasing power of money and the cost of borrowing.

Career progression is another key factor. Advancing in one's profession, taking on more responsibility, or even switching to higher-paying roles can significantly increase earning potential over time. Education and skill development, too, often lead to better job opportunities and higher salaries. So, basically, it's a combination of personal choices, market conditions, and career development that really determines the trajectory of financial growth.

The Importance of Financial Planning

For anyone looking to build or maintain a healthy net worth, financial planning is, you know, absolutely essential. It's about setting clear financial goals, whether that's saving for retirement, buying a home, or funding a child's education. Once those goals are established, a plan helps outline the steps needed to reach them, including budgeting, saving, and investing. Without a solid plan, it's pretty easy to drift financially and miss opportunities to grow wealth.

A good financial plan also involves managing debt effectively. Reducing high-interest debt, like credit card balances, can free up more money for savings and investments, which, you know, really boosts net worth. It also includes protecting assets through insurance and estate planning, ensuring that wealth is preserved for the future and passed on according to one's wishes. This is particularly important for those with substantial assets.

Regularly reviewing and adjusting the financial plan is also key, as life circumstances and market conditions can change quite a bit. A professional financial advisor can often provide valuable guidance in creating and maintaining such a plan, offering expertise on investment strategies and tax implications. Learn more about personal finance on our site, and link to this page financial strategies for more insights. This kind of foresight is, in some respects, what truly sets apart those who achieve lasting financial security.

Frequently Asked Questions About Net Worth

People often have a lot of questions about net worth, and it's understandable, you know, given how central it is to financial health. Here are a few common inquiries:

How is net worth typically calculated?

Net worth is calculated by taking the total value of all your assets and subtracting the total value of all your liabilities. Assets include things like cash, investments, real estate, and valuable possessions. Liabilities are what you owe, such as mortgages, loans, and credit card debt. The resulting figure is your net worth, which basically shows your financial standing at a particular moment.

Does a high income always mean a high net worth?

Not necessarily, actually. While a high income certainly provides the potential to build a significant net worth, it's not the only factor. If a person with a high income also has very high spending habits or substantial debt, their net worth might not be as impressive as you'd think. It's about the balance between income, expenses, and how effectively assets are accumulated and managed over time, you know.

What are some common ways people increase their net worth?

There are several common strategies for increasing net worth. These include saving a portion of income regularly, investing wisely in things like stocks, bonds, or real estate, and paying down debt, especially high-interest debt. Increasing income through career advancement or starting a side business can also boost net worth. It's often a combination of these approaches that yields the best results, you know, over the long term.

Final Thoughts on Financial Journeys

As we've explored, the concept of net worth is a pretty comprehensive measure of financial health, taking into account everything a person owns versus what they owe. While our provided text doesn't give us specific financial details for an individual named "Michael Robinson," it certainly offers a rich backdrop for discussing how different kinds of "Michaels" might navigate their financial paths. From the vast commercial enterprise of "Michaels stores" to the influential stature of "Michael the Archangel" and the high-earning world of Hollywood veterans, each context paints a picture of potential for significant financial standing or influence.

Understanding net worth means looking at diverse income streams, disciplined financial management, and smart investment choices. It's a dynamic figure, you know, constantly shifting with economic conditions and personal decisions. Ultimately, building and maintaining a healthy net worth is a journey that requires careful planning, consistent effort, and a clear understanding of one's financial landscape. It's a continuous process, really, that reflects a person's economic story.

Detail Author:

- Name : Lucious Casper MD

- Username : heathcote.kurt

- Email : trippin@gmail.com

- Birthdate : 2001-03-24

- Address : 473 Rowe Locks Port Wayne, TX 88991

- Phone : +1-585-229-7322

- Company : Moore Inc

- Job : Chemical Plant Operator

- Bio : Laborum animi beatae eaque. Dolor ut possimus ex neque. Nesciunt blanditiis nihil illum molestias a. Hic et ea et qui soluta dignissimos.

Socials

instagram:

- url : https://instagram.com/corbin_dev

- username : corbin_dev

- bio : Quas et et ut totam blanditiis. Quibusdam expedita quis architecto modi et fugiat ducimus.

- followers : 4318

- following : 1441

linkedin:

- url : https://linkedin.com/in/corbin8572

- username : corbin8572

- bio : Magnam tempora est voluptas rerum optio.

- followers : 2222

- following : 2194